A Tale of Two Markets: How to Navigate the VCM's Shift from Spot to Forward

Total forward purchases of carbon removals now exceed 100 million tonnes—over 1.3 times the entire VCM retirement volume of 2023. While headlines focus on a market in decline, our data shows a new, much larger market has already taken its place.

Carbon Credits

Project Development

Jun 25, 2025

Hana El Sarky

Correction (July 9, 2025)

An earlier version of this article contained a data miscalculation in one of the graphs. We have now corrected the chart and updated the relevant figures in the text.

While the specific numbers have been updated, the central thesis of our analysis remains unchanged. We sincerely apologise for this error and are committed to delivering accurate, high-integrity insights.

– The Treeconomy Team

The headlines say the voluntary carbon market (VCM) is in decline. They focus on falling spot prices and lower transaction volumes as proof of a market losing momentum. But this view is missing a much bigger story.

Forward offtake agreements are locking in future supply at a scale that towers over anything we have seen before. And that supply is finite. This isn’t a downturn. It’s a fundamental change in market mechanics, from one-off transactions to long-term financing. The shift toward forward planning has major implications for anyone counting on high-integrity credits to meet their net zero goals.

Comparing the old spot market with today’s forward market, therefore, isn’t about apples and oranges; it's more like comparing a fruit stand to an entire orchard that’s already been pre-sold.

In this analysis, we look beyond the headlines to understand the true trajectory of the VCM by examining both past behaviour and future commitments. Using the MSCI market tracker, we analysed issuance and retirement trends from 2019 to 2024. To create a direct comparison, we then built a dataset of publicly announced offtake agreements, annualising their contracted volumes based on projected delivery yields. This like-for-like comparison reveals a striking story about the evolution of demand and what to expect when delivering on future net-zero targets.

The Writing on the Wall: How Past Retirements Predicted the Future

To understand the scale of the VCM's transformation, it helps to first look at the historical demand. For years, market activity was a blend of different credit types, with buyers retiring both removals, reductions and mixed credits, to meet their goals. This variety shaped a market where different strategies coexisted, and buyers spread their bets across credit types.

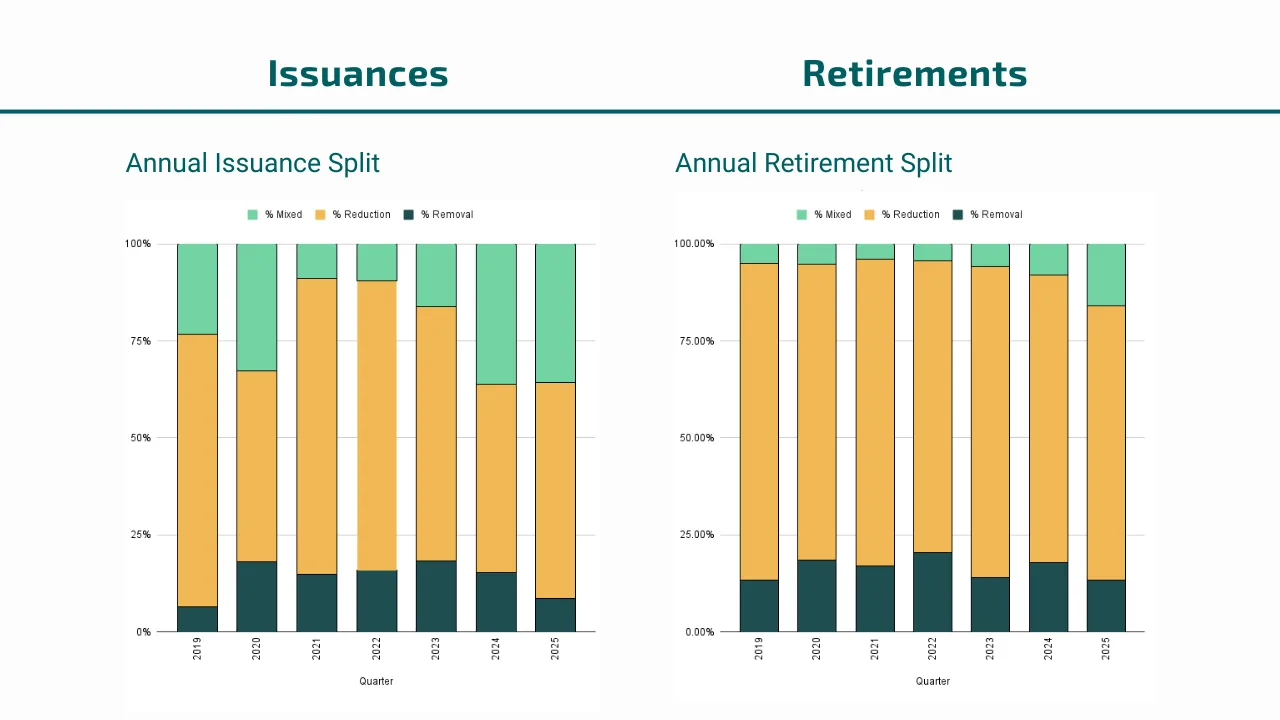

These charts show the annual market share for each credit type, calculated from the total volumes issued and retired between Q1 2019 and Q2 2025.

Historical retirements reflected a diverse portfolio of credit types, this was the market of the past, however. The enormous volume of forward-purchased removals is so large that it guarantees removals will dominate all future market activity.

When compared to historical volumes, the forward-purchased removals now in play largely replace the mixed portfolios of yesterday. This does not happen by a gradual shift in preference, but by the sheer, pre-committed scale of the offtake agreements already signed.

Where the Smart Money is Flowing

It’s clear the forward market didn’t invent demand for removals, it was created in response to it. Buyers had already been signaling their preference through retirements, consistently leaning toward credits with high integrity and clear climate impact. The forward market is simply the result: a new financing mechanism built to secure the very assets the market was already telling us it wanted.

While emissions reductions are still the foundation of any credible decarbonisation strategy, they’re no longer enough on their own. The IPCC has been clear: to meet global climate goals, particularly in hard-to-abate sectors like aviation and heavy industry, we need to scale up carbon dioxide removal (CDR) dramatically: between 5 and 16 gigatonnes annually by mid-century. That pressure is not decades away; by 2030, we need up to ten times the current projected removal capacity.

This is the fundamental driver behind the forward market. Sophisticated buyers who are serious about delivering their net zero commitments understand that waiting is not an option. They are moving to secure removal supply now because they recognise it as an essential component of any credible long-term climate strategy, a fact reinforced by frameworks like the SBTi that push for investment "beyond value chain mitigation". The forward market, therefore, isn't just bigger than the spot market; its composition tells us where the smart money is flowing for the long term.

The True Scale of Forward Commitments

With the demand story in mind, the next question is scale. How big is the forward market and what does it mean for supply?

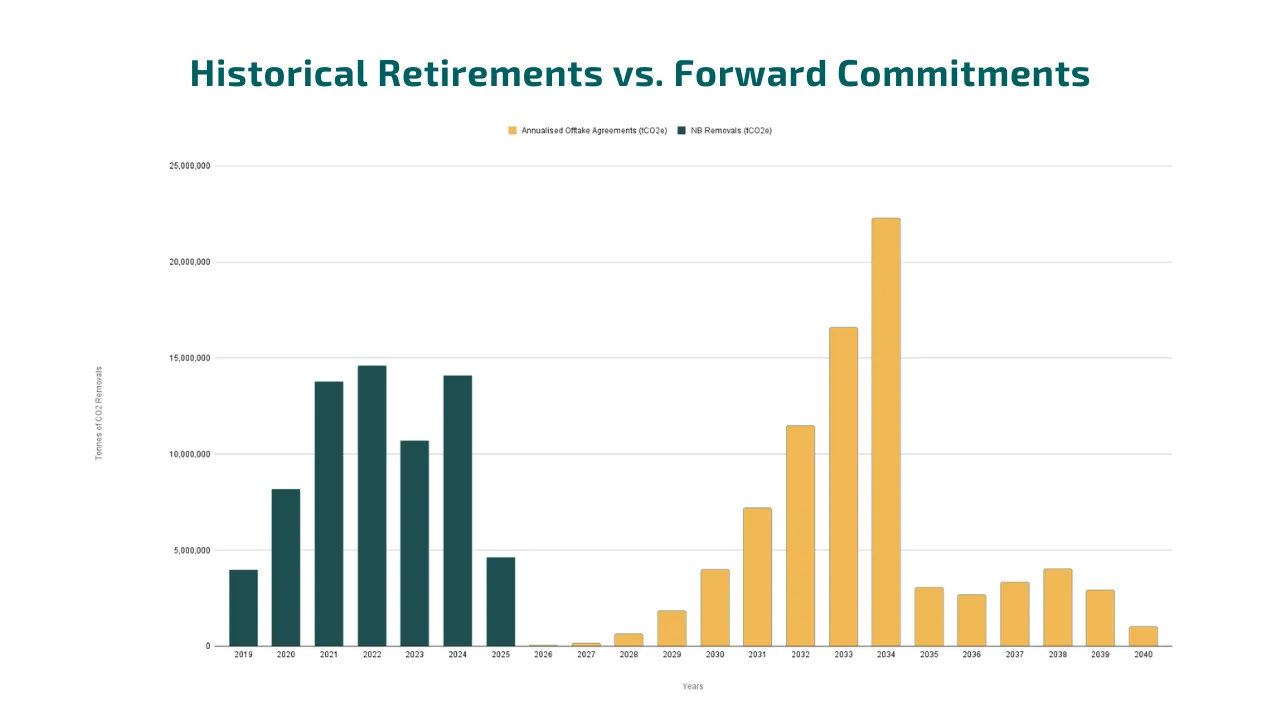

Our analysis comparing annual historical retirements with future annualised offtake commitments, reveals a clear structural change. We see the emergence of a new, parallel stream of demand. The forward market represents a significant, additional layer of committed demand being built on top of the existing spot market.

Historical Nature Based Removal purchases (green) and committed future purchases (yellow). Forward purchases already signed are substantially larger than all historic retirements for carbon removal.

The key insight is that this is entirely new, locked-in demand for a specific asset class: removals. As more companies enter into offtake agreements, this orange block will grow, placing increasing pressure on the finite supply of high-integrity projects. What's more is that this forward demand is driven by a small number of pioneering corporate buyers excluding any future spot market purchases or the growing demand from sovereign buyers, like Singapore and Japan, who are also entering into long-term agreements.

Therefore, the orange block on our chart should be seen as the visible tip of the iceberg. It represents a new, permanent layer of locked-in demand that will compete with all other sources of future demand for a finite supply of high-integrity projects.

The Market Has Moved: What This Means For You

The historical preference for removals, the scientific necessity for them, the sheer size of forward commitments, and the structural reliance on offtakes as a financing engine all point to a single, undeniable truth. A new market is not emerging; it has been built. A "Great Lock-Out" of the highest-quality removal supply is currently underway, led by the market's most sophisticated buyers.

For any organisation with a serious net-zero ambition, the implication is clear. Waiting for removals to become a spot commodity is a strategy based on a market that no longer exists

Understanding this new market dynamic is the first step. For project developers, it’s validation that building with integrity pays off. For buyers, it is a clear signal that the time to secure the removals you will inevitably need is now, before the orchard is sold out for good. If you’re ready to navigate this new landscape, we’re here to help. Contact our team to start the discussion.