From Corporate to Country: The New Buyers Driving the Carbon Market

Beyond the AI boom, a second wave of demand is hitting the carbon market. Discover how sovereign nations are becoming major buyers, raising standards for all.

Carbon Credits

Project Development

Aug 21, 2025

Hana El Sarky

In our last post, we explored how nation-sized corporate demand, driven by the AI boom, is creating a new, supply-constrained reality in the carbon market.

But what happens when that first wave of demand is met by a second, even larger one: nation-states themselves?

Around the world, governments are stepping into the market as buyers, driven by their own legally binding climate targets under the Paris Agreement. This isn't just a trend; it's a paradigm shift that will multiply market volumes, raise standards, and institutionalise carbon removals within international law. This is the story of the market's second wave.

The Second Wave: Why Governments Are Buying Now

The momentum behind sovereign carbon credit purchases has accelerated dramatically since 2023. This new wave of demand is driven by the formal architecture of the Paris Agreement — specifically its Article 6 mechanisms, which establish frameworks for both bilateral, country-to-country trading (Article 6.2), and a new centralised global carbon market (Article 6.4). As countries face tightening national climate targets (NDCs) and rising pressure to show tangible results, they are increasingly turning to the global market to source high-integrity emissions reductions.

This shift is significant for two reasons: scale and credibility. Sovereign actors can commit to purchases at a volume that towers above earlier voluntary market activity, and their involvement will inevitably drive up standards for quality, permanence, and social safeguards.

The Pioneers: Which Nations Are Leading the Way?

A number of forward-thinking governments are already active in the market, establishing the frameworks and signing the deals that will define this new era.

Singapore has emerged as a leader in the space, signing bilateral agreements with six countries: Papua New Guinea, Ghana, Bhutan, Peru, Chile, and Rwanda. These agreements create a structured framework for generating and transferring Article 6-compliant carbon credits, with Singapore targeting 2.5 million tonnes of emissions offsets annually from 2021 to 2030.

Japan has taken an even more ambitious approach. In April 2024, it became the first nation to allow durable CDR credits into its Green Transformation Emissions Trading Scheme (GX‑ETS). Companies will be able to use up to 5% CDR credits, equivalent to approximately 30 MtCO₂ annually from a national emissions base of ~1.1 GtCO₂. This initiative is part of Japan’s wider strategy under its GX‑League, where more than 600 large companies now participate in a voluntary carbon market that’s transitioning toward mandatory cap‑and‑trade by 2026. These GX‑ETS credit allowances add a strong compliance-driven demand layer to existing corporate and voluntary offtake pressures. Complementing the GX‑ETS, Japan employs two major credit schemes:

- Joint Crediting Mechanism (JCM): Since 2013, this bilateral program has issued credits from decarbonisation projects in 30 partner countries, with Japan playing a co-investor and co-beneficiary role.

- J‑Credit Scheme: A domestic initiative that certifies emission reductions or removals within Japan, providing credits usable under GX‑ETS.

Resultingly, Japan’s GX‑ETS and JCM represent a powerful, compliance‑backed demand signal for nature‑based removals. They've shifted from voluntary action to a tightly regulated system, and are already shaping the global forward‑market dynamic.

Switzerland has recently completed the first-ever Article 6.2 deal with Thailand for a transfer of carbon credits. Beyond Thailand, Switzerland has signed similar bilateral deals with Peru, Ghana, Senegal, Georgia, Dominica, Uruguay, Malawi, and Vanuatu, demonstrating the country’s commitment to using internationally transferred mitigation outcomes (ITMOs) — emissions reductions that are authorised for transfer from one country to another to help meet climate targets — to support its NDC.

These sovereign-level transactions are sourced from nature‑based projects in forestry, clean cookstoves, and waste‑to‑energy. By incorporating these ITMO purchases into its national emissions accounting under the Swiss CO₂ Act, Switzerland is signaling early demand for high-integrity removal pathways, setting a precedent for other nations and sovereign buyers to engage in forward carbon procurement

Most recently, the European Union has announced that the 2040 climate target will allow member states to use international removals for up to 3% of their goal from 2036. This signals a massive potential future demand, possibly in the tens of millions of tonnes annually.

This is likely only the beginning. As German environment minister Carsten Schneider remarked, these movements send a strong signal to other major economies, noting, "This can motivate China, India, Brazil, South Africa and others to follow suit".

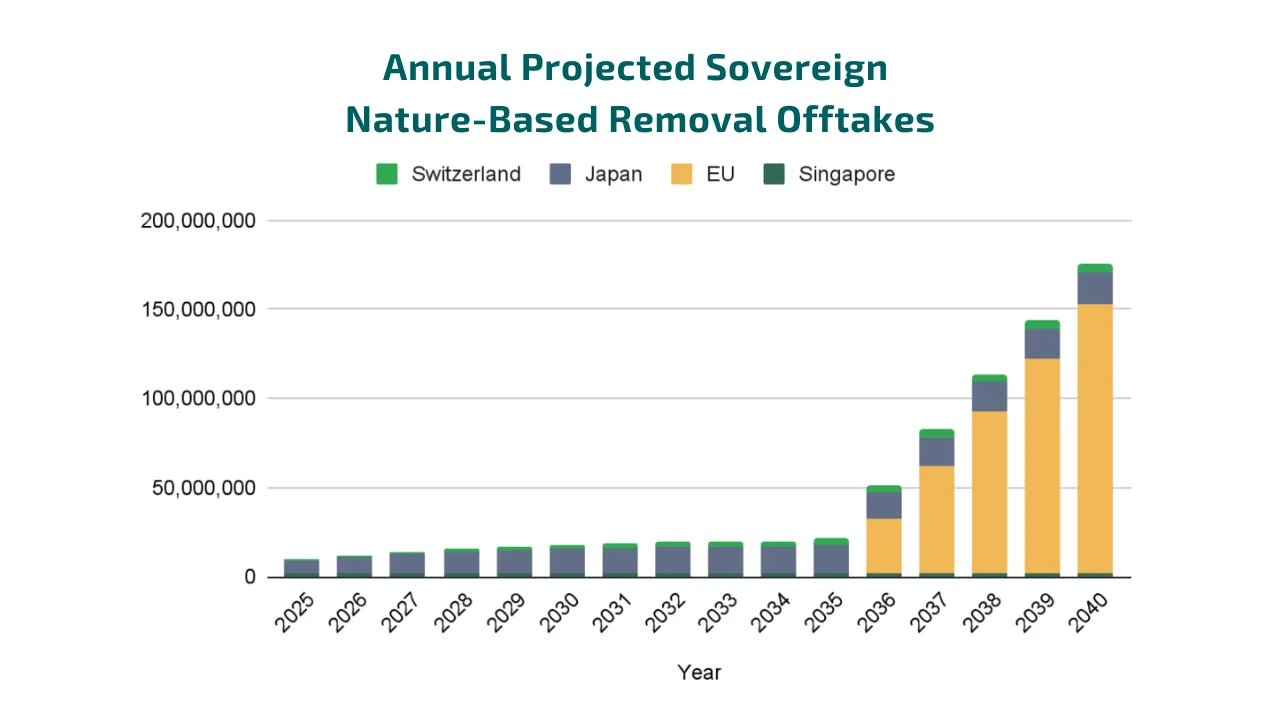

The following chart displays a projection for future sovereign purchases from just four jurisdictions.

Our projection shows how sovereign demand is set to build over the coming decade. Early movers like Singapore create a stable baseline, while Japan and Switzerland drive steady, incremental growth as their compliance programmes mature.

The most significant shift occurs in 2036 with the EU's planned entry into the market. This deliberate legislative timeline—focusing on domestic reductions first—is set to create a massive spike in demand for international credits, potentially reaching over 100 million tonnes annually. This ensures the long-term growth of the market is underpinned by robust, compliance-driven demand.

Certainty Over Speculation: Why Sovereigns Favour Offtakes

A key feature of this sovereign-led market is a structural preference for long-term offtake agreements over short-term spot purchases. States require certainty to meet their multi-year climate targets, and offtakes provide stable, predictable revenue guarantees for project developers. This signals a new era of volume and price stability for the removals market, as the integrity requirements of Article 6 ensure that credits are uniquely counted and of high quality.

The arrival of sovereign buyers can be expected to have several implications for the Future Removals Market:

- Quantitative Impact: New sovereign demand is likely to multiply annual market volumes, with credible projections in the tens to hundreds of millions of tonnes annually by 2030.

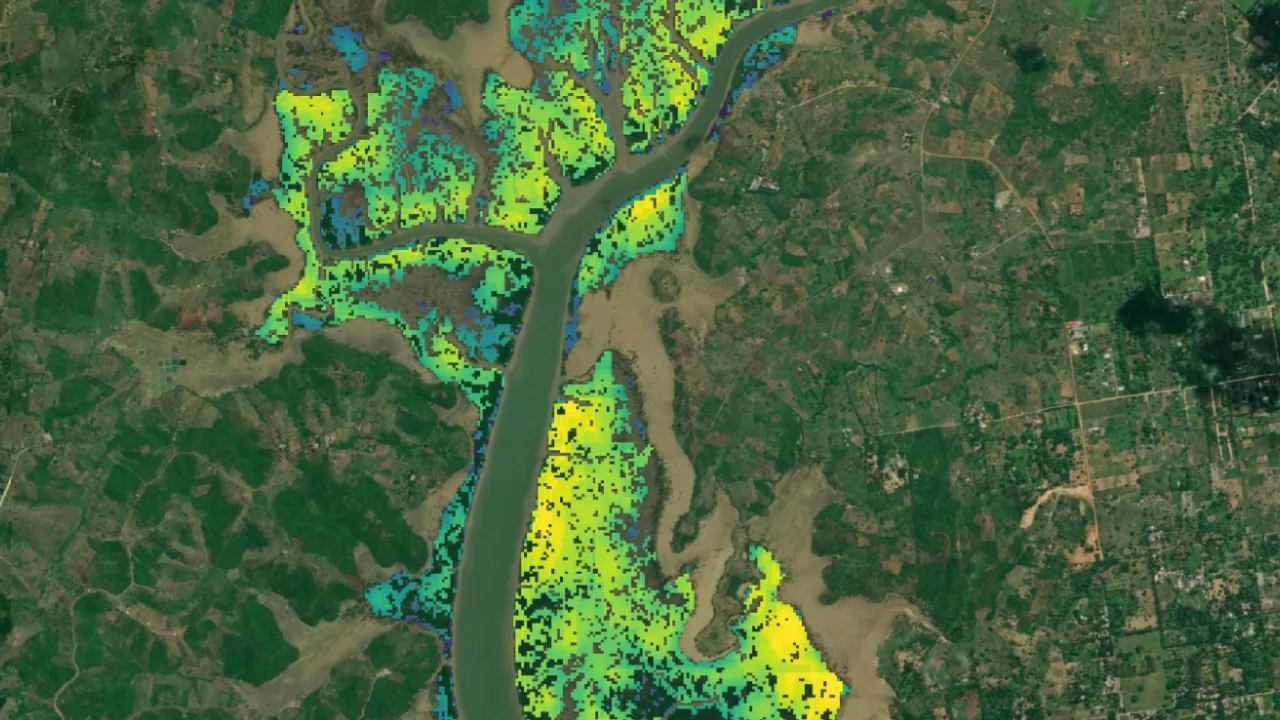

- Focus on Nature: Nature-based removals, especially jurisdictional-scale REDD+ projects in rainforest nations, will see the lion’s share of early sovereign demand due to their ability to deliver volume and significant co-benefits.

- Higher Standards: State-led demand will drive up standards for quality and integrity, making it harder for low-quality credits to find a market.

- A Catalyst for Restoration: High, predictable demand for nature-based credits can finance massive ecosystem restoration, support local communities, and accelerate global biodiversity goals.

Why This Matters for Nature Restoration & Carbon Removals

Sovereign demand represents a paradigm shift, institutionalising carbon removals within national and international climate law. This demand will ensure greater market integrity, scale financing to where it's needed most, and create a stable backbone for the entire removals industry. The era for nature-based credits is in action, one driven by the planet’s policymakers as much as by the private sector.

This dual-driver market—powered by both corporate and sovereign demand—creates clear imperatives for everyone.

For corporate buyers: The market is no longer just supply-constrained; it's becoming highly competitive. With nation-states entering the market, securing a long-term, high-integrity supply of removals is more critical than ever. De-risk your climate strategy before the best projects are gone.

For project developers: This new wave of sovereign demand creates an unprecedented, bankable opportunity. To meet the high standards of these new buyers, project credibility is key. If you are ready to build, we can help you access the finance and expertise required.