The AI Carbon Boom: How Artificial Intelligence is Locking In a Decade of Climate Action

The voluntary carbon market's new reality isn't driven by sentiment; it's being underwritten by the massive energy demands of AI. Here's why the market is now fundamentally supply-constrained.

Carbon Credits

Project Development

Jul 10, 2025

Hana El Sarky

Introduction

The Voluntary Carbon Market (VCM) has been defined by volatility and sentiment. Corporate demand would rise and fall with budgets, headlines, and shifting priorities, making long-term planning a challenge for developers and investors alike. That era is over.

In our previous blog, we explored the VCM's structural shift towards a forward-committed market. Now, a powerful new catalyst is accelerating that trend: the immense energy demands of AI. This has created a new market reality, moving from speculative, year-to-year purchases to one built on a solid foundation of long-term, contracted demand.

A New Foundation: The Market in Numbers

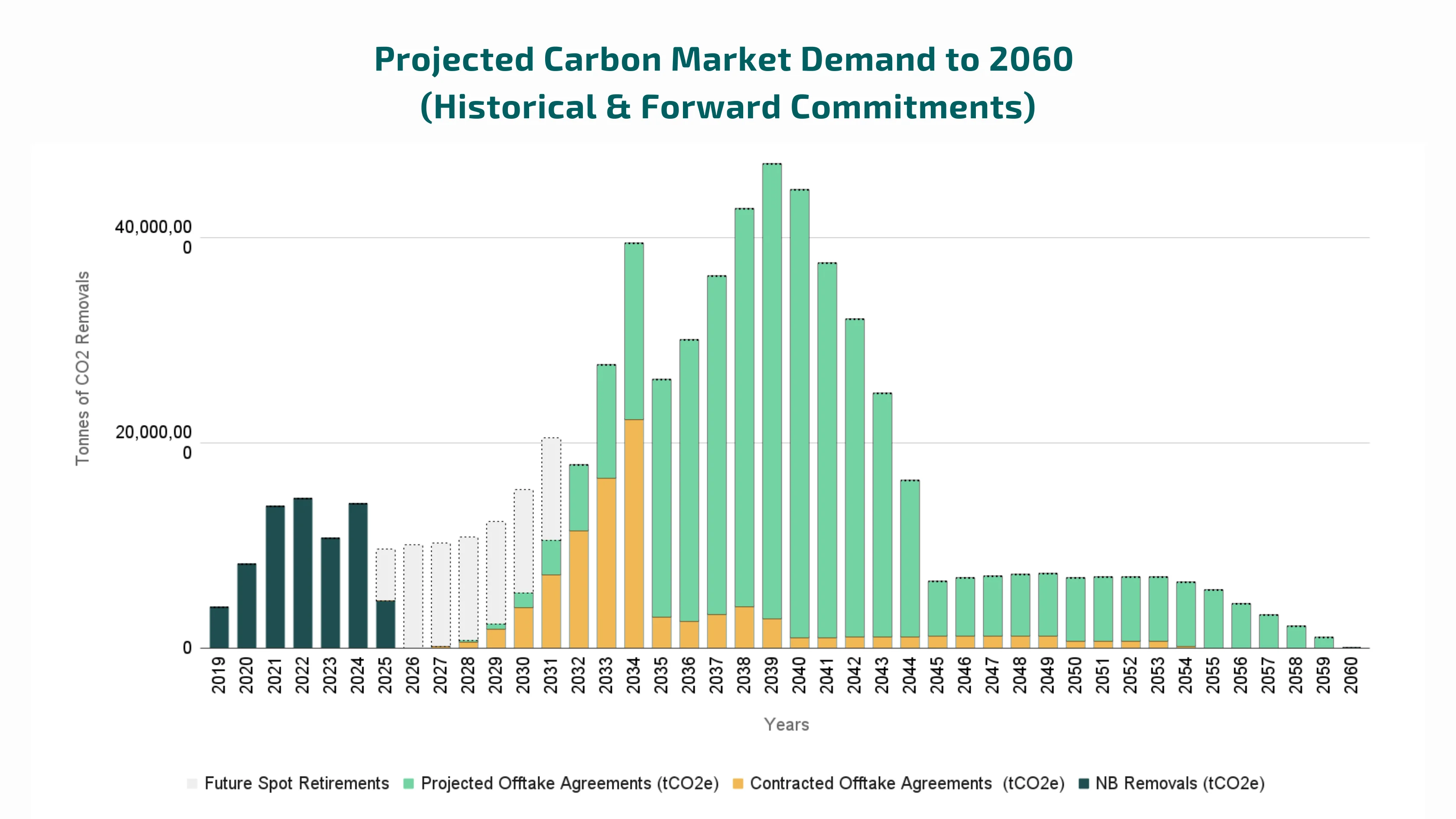

This projection shows the compounding effect of an estimated 75 million tonnes of new removal contracts being signed each year for the next five years. The long-term nature of these deals creates a multi-decade pipeline of guaranteed demand.

Above we see a visualisation of the upcoming shift to the carbon market. Rather than being determined by volatile and unpredictable spot purchases, the future market is built on 'offtakes’: long-term, legally binding agreements to purchase carbon removals for years into the future. The chart compares the small, fluctuating demand of the past with a massive, locked-in pipeline of future demand.

Here’s the breakdown:

- A new baseline: The graph layers committed offtake agreements, showing how demand is now guaranteed for the next 15 years. This is based on contracts already signed (Gold bars).

- Projected growth: To project future growth, we've added a conservative estimate of 75 million tonnes of new contracts being signed each year for the next five years. This is based on the real-world pace of agreements signed over the last 18 months. (Green bars)

- Long term nature: Nature-Based Solutions (NBS) for Carbon Dioxide Removal (CDR) are currently the only technology that can deliver removals at the scale these companies need. Since these projects take 12-15 years to mature, buyers must sign long-term offtake agreements today to secure their future supply. This effectively underwrites demand for more than a decade, making these long-term projections a market necessity, not just a forecast.

- The market transition: The visual contrast between past retirements and future offtakes tells the story. The challenge is no longer finding buyers; it's finding enough high quality projects to meet this guaranteed demand. The race is on to build.

Find our open source data on how we pulled this together here.

The AI Demand Engine: Why This Time Is Different

While some companies have managed to slow or even slightly reduce their emissions, the overall trend remains upward, especially for those most heavily invested in AI. According to the UN’s “Greening Digital Companies 2025” report, “AI is not only data hungry but also energy hungry, and, as the AI expansion continues, increased energy demand could put pressure on the existing energy infrastructure and jeopardise energy transition targets.”.

Emissions Change Table: 2020–2023

Company | % Increase in Emissions (2020–2023) |

Amazon | 182% |

Microsoft | 155% |

Meta | 145% |

Alphabet (Google) | 138% |

The most dramatic emissions increases from tech giants were reported in 2023, as shown above. This initial surge is driven by the extreme energy intensity of AI workloads - a single ChatGPT query can use ten times the electricity of a standard web search. Yet, this is just the prelude. These large-scale AI data centers typically take 2-4 years to build, meaning the full emissions impact of this expansion hasn’t arrived yet, but it’s already baked in.

The surge in emissions is therefore a guaranteed outcome of infrastructure already underway. As this next generation of AI facilities comes online between 2025 and 2027, their carbon footprint will continue to climb at an accelerated rate.

And the growth is only accelerating: Meta’s 2025 capital expenditure is forecast at $64-72 billion, nearly double the $35-40 billion expected in 2024. Similar multi-billion-dollar commitments have been announced by Microsoft, Amazon, and Alphabet. The explosive growth of Artificial Intelligence is the engine driving this transformation, but the full impact on emissions has not even hit yet.

A Wave of Inevitable Emissions

This is the context behind today’s spike in demand for carbon removals. The largest offtake agreements in the VCM are being signed by the same companies leading the AI revolution. Their need is not optional. The massive capital expenditure required for AI, building and powering data centers around the globe, creates a correspondingly massive and unavoidable carbon footprint. As billions are invested in AI infrastructure, they are simultaneously creating a non-negotiable, long-term need for gigatonnes of carbon removal to meet their net-zero commitments.

To put the scale of this need into perspective, the carbon footprints of these individual companies are already on par with those of entire countries. In 2023, Amazon's total emissions (68.8 MtCO₂e) surpassed the national emissions of developed nations like Switzerland (40.8 MtCO₂e) and Finland (38.0 MtCO₂e). The combined 2023 emissions of just Microsoft and Google (approx. 29.3 MtCO₂e) were larger than the entire national footprints of Croatia (25.0 MtCO₂e), Jordan, and Paraguay combined.

This creates a powerful and predictable demand signal the VCM has not seen before. Based on the pace of publicly announced offtake agreements over the last 18 months, the market is demanding an average of 75 million tonnes of new forward purchases each year. Given the locked-in nature of AI capital expenditure, projecting this demand forward for the next 3-5 is likely quite a conservative estimate. Here’s why:

- Accelerating AI growth: The energy consumption required for AI is projected to increase exponentially, meaning the associated emissions (and the need for removals) will grow, not flatline.

- Major deals yet to come: We still haven't seen the full impact of major commitments from the largest players. The Symbiosis coalition is targeting 20Mt of purchases by 2030, and we are yet to see their first contracts signed.

- Buyer pool expansion: Today, only a few tech giants are driving public offtake activity, but with the tech sector expanding rapidly, and emissions growing alongside it, a broader wave of buyers is expected to follow.

The forward-looking pipeline is therefore no longer based on sentiment. It is based on bankable purchases, long-term commitments tied to the foundational infrastructure of the next technological revolution.

The Market Is Now Supply-Constrained

The emergence of a predictable, multi-decade demand pipeline is a breakthrough for the Voluntary Carbon Market. It solves a long-standing challenge: buyer hesitancy. But in doing so, it has revealed a new, more urgent problem: the market is now fundamentally supply-constrained.

The current pipeline of high integrity removal projects is nowhere near sufficient to meet the scale of demand we now see forming. Most of the projects that exist today were developed for a short-term, transactional spot market, not for a future where AI hyperscalers are committing to purchase hundreds of millions of tonnes over 10 to 20 years.

Right now, the most available form of high integrity carbon removal is nature-based solutions (NbS), particularly reforestation and afforestation projects. These require a minimum of 12 to 15 years for trees to mature and generate meaningful volumes of carbon removal. For project developers and financiers, that timeline demands revenue certainty, and that’s what long-term offtake agreements provide.

The shape of the forward market is therefore being defined by a collision of two forces:

- A new class of demand from corporate buyers, especially those in the tech and AI sectors, who are serious about securing long-term carbon removal.

- A supply base that inherently requires patient capital and multiyear commitments to be financially viable.

The result is a market structure that mirrors the biological timeline of nature itself. While emerging technologies like biochar, enhanced rock weathering, and direct air capture will gradually complement this base, the current forward market is being built around forests.

The Challenge Has Shifted

This guaranteed, multi-decade demand pipeline solves one of the VCM's oldest problems, but it immediately puts the spotlight on a new one: the market is now fundamentally supply-constrained.

The current pipeline of high integrity removal projects is simply insufficient to meet this newly solidified, long-term demand. The projects available today were developed for the old, volatile spot market, not for a new reality where AI giants are seeking to pre-purchase hundreds of millions of tonnes. Developing new, high quality nature-based removal projects at scale takes years, from land acquisition and community engagement to planting and monitoring. The supply side now needs to work hard to catch up.

Rather than being a story about scarcity for buyers; we are hearing a call to action for the entire supply-side ecosystem. The demand is no longer a question; it's a powerful, bankable "pull" signal from the market's most credible players. For project developers, this is the greenlight to build. For financiers and investors, the time to deploy capital into creating new, high integrity removal projects is now. The challenge has shifted from finding a buyer, to financing and developing quality projects fast enough to meet the demand that is already here.

The opportunity this new reality presents is clear for both sides of the market.

For corporate buyers: The race to secure high-integrity, long-term supply is on. To de-risk your net-zero strategy and ensure you have access to a credible portfolio of removals, the time to act is now.

For project developers: This is the greenlight. The market is providing a clear, bankable signal for new, high-quality projects. If you are ready to build, we can help you access the financing and market expertise you need.