Net Zero vs Carbon Neutral: What’s the difference?

Making sense of different emissions targets

Carbon Credits

Mar 15, 2024

Siya Kulkarni

In a world where the impacts of climate change are increasingly evident, the need for action has never been more urgent. With rising global temperatures projected between 2021 and 2040, as outlined in the 2023 report by the Intergovernmental Panel on Climate Change (IPCC), the imperative to curb anthropogenic emissions is paramount. Governments and organisations alike are responding with commitments to reduce emissions, often through the establishment of net zero emissions targets or the pursuit of carbon neutrality.

What are net zero and carbon neutrality?

According to the UN, “net zero” refers to “cutting carbon emissions to a small amount of residual emissions that can be absorbed and durably stored by nature and other carbon dioxide removal measures, leaving zero in the atmosphere.” Carbon neutrality, on the other hand, refers to balancing out today’s greenhouse gas emissions from one source by removing an equivalent amount by creating carbon sinks.

The Science Based Targets initiative (SBTi) has stipulated in its Corporate Net Zero Standard that companies need to reduce emissions by 90% to hit their net zero targets, which implies 10% in residual emissions.

Global emissions need to be cut by at least 45% by 2030, and need to be “net zero” by 2050, in order to maintain global warming within the 1.5 degree threshold. As of November 2023, 66% of the annual revenue of the world’s largest 2000 companies (or $27 trillion on an aggregate basis) was covered by some form of a net zero target.

In terms of progress and impact, Net Zero Tracker has found some shortcomings in existing targets and ambitions. For instance, while a majority of fossil fuel companies have made net zero commitments, unclear phase out plans for oil and gas means the targets are misaligned with science-based needs.

The road to net zero is expected to be a trying, and long journey, as uncertainties remain about the pace and impact of climate transition plans.

However, emissions reductions made today are just as necessary in order to generate environmental and social benefits

This is where carbon neutrality comes to play.

Organisations that strive to be carbon neutral in the near term typically do so in order to offset their emissions today, while making transition plans for the future. Data from Climate Impact Partners shows that around 65% of the Fortune 500 companies that have already set significant climate commitments have also set carbon neutrality targets.

Carbon neutrality is a near-term target, that can be applied to an entire organisation, a project, or a specific asset.

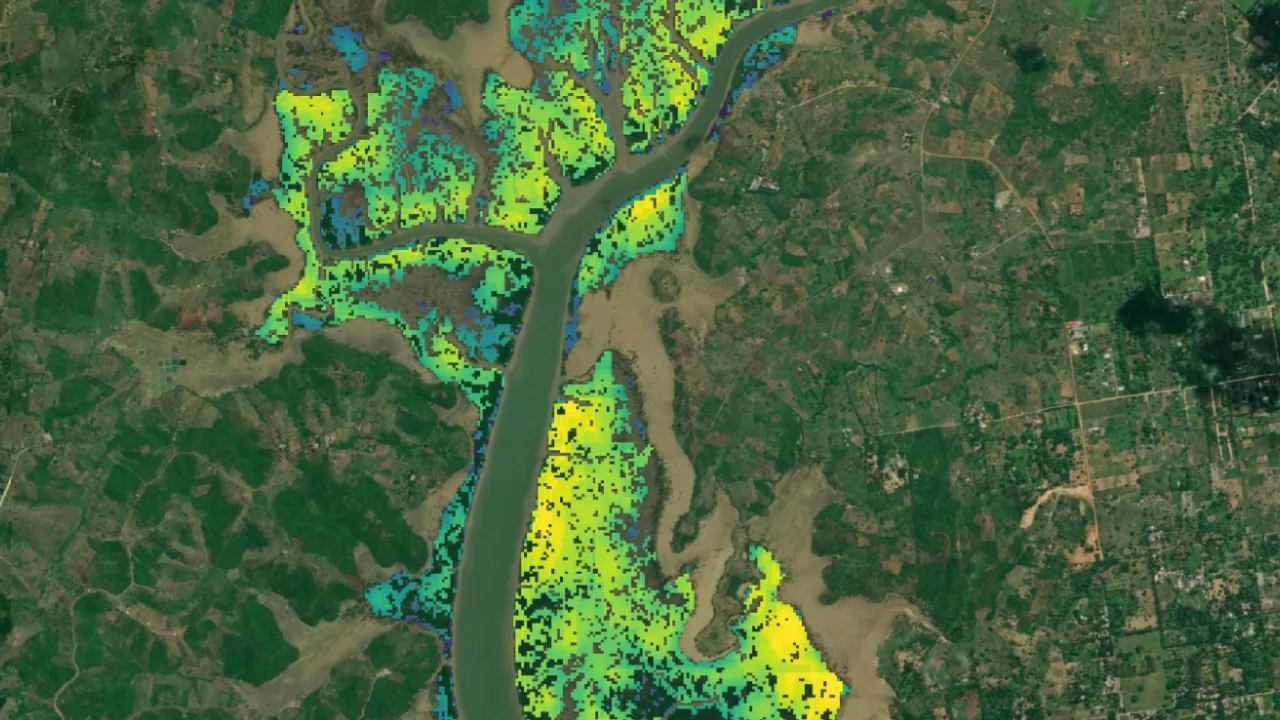

Organisations typically achieve carbon neutrality in the near term, where they are unable to immediately abate their emissions, by investing in carbon offsets that are equivalent to their emissions. These offsets are generated by the creation of carbon sinks, that actively remove carbon from the atmosphere. Carbon removal projects can be engineered (such as direct air capture), or nature-based (such as afforestation), and generate credits for every tonne of CO2 equivalent removed from the atmosphere.

Why does this matter today?

Despite their differences, both net zero and carbon neutrality are crucial steps in the fight against climate change. Carbon neutrality offers an immediate solution for companies looking to mitigate their emissions, while net zero sets a long-term goal for decarbonisation.

However, achieving these targets is not without its challenges. Carbon removal projects are currently limited in availability compared to the significant emissions removal needs of today. Nature-based projects, in particular, require many years to absorb large volumes of carbon from the atmosphere, while technological solutions demand substantial capital for large-scale implementation.

Nature-based carbon removal projects such as afforestation and natural regeneration not only serve as carbon sinks, but also provide vital co-benefits to the environment and societies by way of enhancing biodiversity and adaptation to climate change impacts, as well as increasing sources of sustainable employment and income for local communities.

While carbon offsetting seems straightforward in theory, many organizations' offsetting plans face scrutiny and criticism in practice. For one, many companies offset their emissions not only with removals, but also carbon reduction and avoidance credits. Carbon Brief found that around half the offsets purchased by companies comprise of REDD+ projects that generate nature-based avoided emissions credits, many of which have been subject to environmental justice-related controversies.

Standard setters and leading authorities have responded to these challenges. The recently revised Oxford Offsetting Principles have emphasised the need for organisations to shift towards a removals-based approach to carbon offsetting. Additionally, they call for the purchase of high-durability credits from new removals projects today, to ensure that these projects have the intended impact in the future. Meanwhile, the SBTi stipulates that the 10% residual emissions after a decarbonisation plan has been set in place may only be offset using permanent carbon removal credits.

One thing is clear: organisations can employ both net zero and carbon neutrality approaches to maximise the impact of their transition efforts over the coming years until 2050 and establish themselves as leaders in climate action.

How Treeconomy can help

At Treeconomy, we recognise the importance of both net zero and carbon neutrality in the transition to a sustainable future. Our marketplace offers high-quality, nature-based carbon removal solutions, ensuring that environmental and social co-benefits are embedded within each project. We support organisations to achieve both short and long-term emissions targets.

Interested in purchasing nature-based carbon removal credits with us? Explore our pipeline of projects by visiting Treeconomy’s marketplace here or contact us at hello@treeconomy.co.