What Influences The Price of a Carbon Credit?

Pricing as a signal for credit quality

Carbon Credits

Feb 28, 2024

Siya Kulkarni

The voluntary carbon market (VCM) is a largely unregulated, or self-regulated space, valued at almost $2bn in 2022. While the volume of credits traded dropped substantially from 2021, the overall value of the market was buoyed by an increase in prices.

Interestingly, this price increase was driven by nature-based restoration projects - particularly those with added social and environmental benefits outside of carbon sequestration. Buyers of carbon credits are becoming increasingly discerning about the impact of the projects they purchase credits from, with high-integrity, high-quality projects seeing strong demand. Stronger demand in turn leads to higher pricing.

So, what are the main considerations for buyers and issuers when pricing carbon credits?

Project type

The type of project is one of the first markers that influence pricing. Generally speaking, carbon removal projects are priced higher than carbon avoidance projects, or improved forest management (IFM) projects. This is because carbon removal projects involve the actual removal or sequestration of carbon from the atmosphere, and usually require more inputs for project development and management. Removal projects such as afforestation or habitat restoration with biodiversity benefits involve the restoration of deforested or degraded land, whereas avoidance projects look into land with pre-existing forest cover.

Not only do costs and inputs affect pricing for removal projects, but also claims on additionality and carbon neutrality for buyers. For example, an offtake buyer who looks into purchasing carbon credits from a removal project can be involved in the project development process ground-up and can finance a project that restores formerly degraded land via active interventions. Such projects would be higher in demand for buyers seeking additionality and high environmental impact with their purchases, so credits generated from these projects would be priced higher.

Co-benefits and cash flows

Speaking of impact, an important consideration are additional benefits that the projects offer beyond carbon sequestration.

Carbon projects, particularly removals and IFM projects, are often developed with additional revenue streams in mind. These revenue streams include agroforestry and timber yield, renewable energy generated from mixed-used terrestrial projects, as well as payments for other ecosystem services such as eco-tourism. Additional revenue streams are particularly appealing to project finance investors and landowners, increasing the value of the overall carbon project.

However, not all projects may be developed on land owned by the project proponents themselves. Many projects, including some of Treeconomy’s projects, are being developed on state-owned land parcels, such as our Grand Katanga Reforestation Project, or parcels of land owned by smallholder farmers. Such projects require the involvement of the local community and authorities to approve the project as well as assign carbon rights to the developer. In turn, projects are designed to create co-benefits - which include improvements in community well-being, livelihood creation and employment, biodiversity enhancements, and adaptation benefits.

Ensuring carbon project co-benefits is not only a responsible and ethical business practice for the buyer but also benefits the buyer by ensuring the longevity and durability of the projects. Incentivising communities to participate in the project development and management process ensures that a project is sustained over the long term, often over many generations. This benefit to the buyer is reflected in pricing: projects with SDGs have been found to attract premium pricing.

Geography

Where a project is located significantly impacts its pricing, for several reasons.

One of the biggest concerns for buyers is country-level risk. Projects based in areas where there is greater political instability that might damage or interfere with the development process are likely to be valued lower. Similarly, projects that are based in areas that are vulnerable to climate change impacts such as wildfires or flooding are also priced lower due to the risk of credit misdelivery or losses.

Carbon prices also vary based on the regulatory environment surrounding climate change, and national priorities for emissions targets. Prices are often higher for credits issued in geographies with a more supportive environment for high-quality carbon project development or stricter emissions rules that drive demand for carbon credits among domestic buyers.

The macroeconomic environment also impacts pricing - economic downturns often lead to “flights to safety”, carbon credit purchases are carried out more selectively, and demand shifts towards lower-risk projects and jurisdictions, further reducing the price of riskier projects.

Timing

When a carbon credit is issued, and when it is delivered, is a big consideration for buyers. In a previous blog, we discussed the difference between ex-post and ex-ante credits. Ex-post credits are priced higher than ex-ante credits because they have been verified, and represent carbon that has already been sequestered, removing any uncertainty about delivery.

Ex-post credits are also used by organisations to meet their net-zero targets under SBTi guidelines. While demand for ex-post credits is high, the availability of suitable ex-post credits is low - further driving up prices.

Pricing is not only affected by whether a credit has been delivered but also by when it was delivered - i.e., its vintage. A vintage is the period during which carbon removals or avoidances have occurred or when the carbon credit is issued. While in theory, a tonne of carbon sequestered should have the same value no matter when it was sequestered during the project development process, many buyers are seeking out credits issued from more recent vintages. Newer vintages attract higher pricing because they are issued using updated methodologies for the measurement of carbon sequestered from a project.

Risk management

While many of the factors mentioned above address some form of risk to the project - operational, jurisdictional, or delivery - it is meaningful to look at how these risks are mitigated by project developers to ensure that credits remain of the highest quality and integrity, deliver on their sequestration claims, and ensure that all stakeholders benefit from the project fairly and equitably.

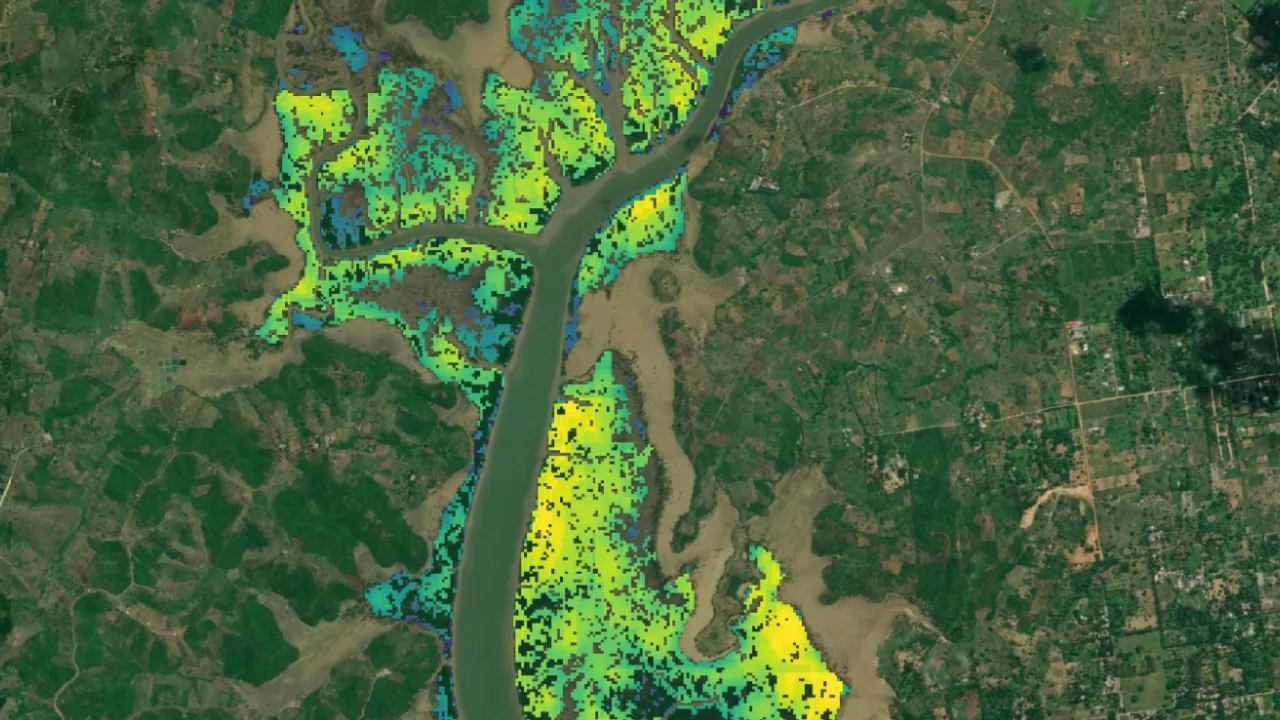

While many administrative risks are managed by ensuring strong governance structures are put in place for the project, or by exploring any regulatory or legal hurdles in the development process, physical risks to the project are less straightforward to manage. One of the most effective ways to address this issue is the use of frequent monitoring to assess changes in carbon stock over the project lifecycle. Digital monitoring delivers fast, reportable data that brings transparency and accountability to the project development process, and de-risks the project. Frequent monitoring and reporting embedded in the development process can therefore allow credits to be traded at a premium.

Pricing outlook

As organisations approach their emissions target deadlines, demand for carbon within the VCM will only increase. Many forecasts for carbon pricing, particularly for removal credits, have predicted large leaps in carbon pricing between 2030 and 2040, as organisations race to meet targets while also ensuring credits are of the highest quality and impact.

At Treeconomy, we strive to ensure that projects are de-risked, transparent, and developed with the highest standards. With our proprietary monitoring and carbon measurement tools, we support the supply of carbon credits, delivering trust, traceability, and transparency. This reassures buyers that the credits they purchase have been developed with best practices and a highly positive social impact in mind.

For more information on co-benefits, de-risking mechanisms, and carbon measurement, feel free to contact us or take a look at our monitored carbon removal projects on Treeconomy’s marketplace.

–

Ready to purchase carbon credits with us? Explore our pipeline of projects by visiting Treeconomy’s marketplace here or contact us at hello@treeconomy.co.