Vintages Unpacked

Why timing matters for credit issuance and purchase

Carbon Credits

Apr 9, 2024

Siya Kulkarni

In a previous blog, we explored how a carbon credit may be valued in the context of various risk-related factors. One of these factors was the vintage of a carbon credit.

So, what is a vintage, and why does it matter for credit buyers?

A vintage may refer to one of two things:

- the timing of the carbon credit issuance, or

- when the carbon removal actually occurred.

Carbon credit purchasers often look at the timing of carbon issuance, or its vintage, when making a purchase decision. This involves a number of considerations that can ultimately impact the quality, or even the perceived quality, of a credit. Vintages are particularly important for nature-based carbon credits due to the associated projects’ variability and exposure to physical and regulatory risks over their lifetime.

Some of these considerations are listed below:

1. Ex-post vs ex-ante: Has the credit been issued?

One of the most common determinants of pricing and a mover of demand-supply mechanics is whether a credit has already been issued or is projected to be issued in the future.

Ex-post credits are credits that have been issued (and hence from older vintages), where the removal has already taken place and verified. For risk-averse credit purchasers, ex-post credits are attractive options as they do not bear the risk of non-delivery, and a retirement can occur immediately. Moreover, the Science Based Targets initiative (SBTi) stipulates that to claim net zero emissions, an organisation that uses removals to offset residual emissions must ensure that the removals are verified ex-post, with the vintage being “no further than 3 years from the period in which the carbon removal will be used for neutralisation purposes.” This is where duration matching for credits and emissions matters for corporate strategy, and the timing of credit issuance can impact their perceived value for purchasers.

On the other hand, ex-post credit availability for nature-based carbon removal projects is limited, and purchasers would also look towards forward-looking credit issuance, or ex-ante credits, based on pre-purchase or offtake agreements. Ex-ante credits are generated from future vintages, and while riskier than ex-post credits, they allow buyers more options and more opportunities to engage long-term with the project development process.

Both ex-post and ex-ante credits are valuable for different reasons. Where demand for ex-post credits may be high, and supply is low, prices for ex-post credits may be driven up versus comparable ex-ante credits.

2. Timing as a signal for quality

This is a slightly more complex (and potentially misleading) way to assess a credit.

Permian Global found that buyers tend to perceive credits from older vintages as lower in quality than newer vintages and often tend to be priced lower. While some of these credits are viewed as having a depreciating value as a commodity, many buyers take the view that older credits generated based on older methodologies and standards may have a different level of integrity than newer standards that have evolved to be more rigorous. Permian also found that many corporates seek to match the timing of credit issuance to the timing of emissions for clarity in reporting.

However, these assumptions may not hold water from a scientific perspective. The recency of credit issuance matters as a signal of impact and value - but not in the sense that corporate buyers are viewing this. Carbon sequestered earlier is more impactful in the path to limiting warming under 1.5°C. Additionally, methodology may not be the only signal for the quality of a credit. Rigorous carbon accounting and reporting can demonstrate the impact of a project comparable to today’s standards, and more mature forestry projects that are still standing also signify durability and longevity.

3. Informational issues

Carbon rating agency BeZero defines a vintage gap as the “duration within a project's crediting period within which data associated with emission reductions or removals is unavailable, or credit issuance is amiss.”

These gaps often result from transfers of carbon projects across different standards and methodologies, for example, transfers from Clean Development Mechanism (CDM, the earliest voluntary carbon registry system) to other methodologies, such as Verra or Gold Standard, to extend the projects’ crediting period. Inconsistencies among these standards, as well as incomplete documentation and unavailability of auditors for specific monitoring periods, can also create vintage gaps. Many gaps are also unknown due to insufficient public information or explanations.

Vintage gaps were found to be most prevalent within the energy sector. Fortunately, the occurrence of vintage gaps is lower for forestry projects, as most projects sit under Verra and are rarely transferred to other standards, reducing the risk of these gaps.

Takeaways

Vintages are an important factor when assessing projects. They are a determinant of price, durability, and longevity, provided they are assessed on the basis of the quality of reporting and project implementation.

It is also important to remember that vintages are not always the best indicator of quality or price. Buyers must evaluate factors such as additionality, permanence, and reversal risk against many other indicators, such as geography, community safeguards, environmental justice metrics, and data quality.

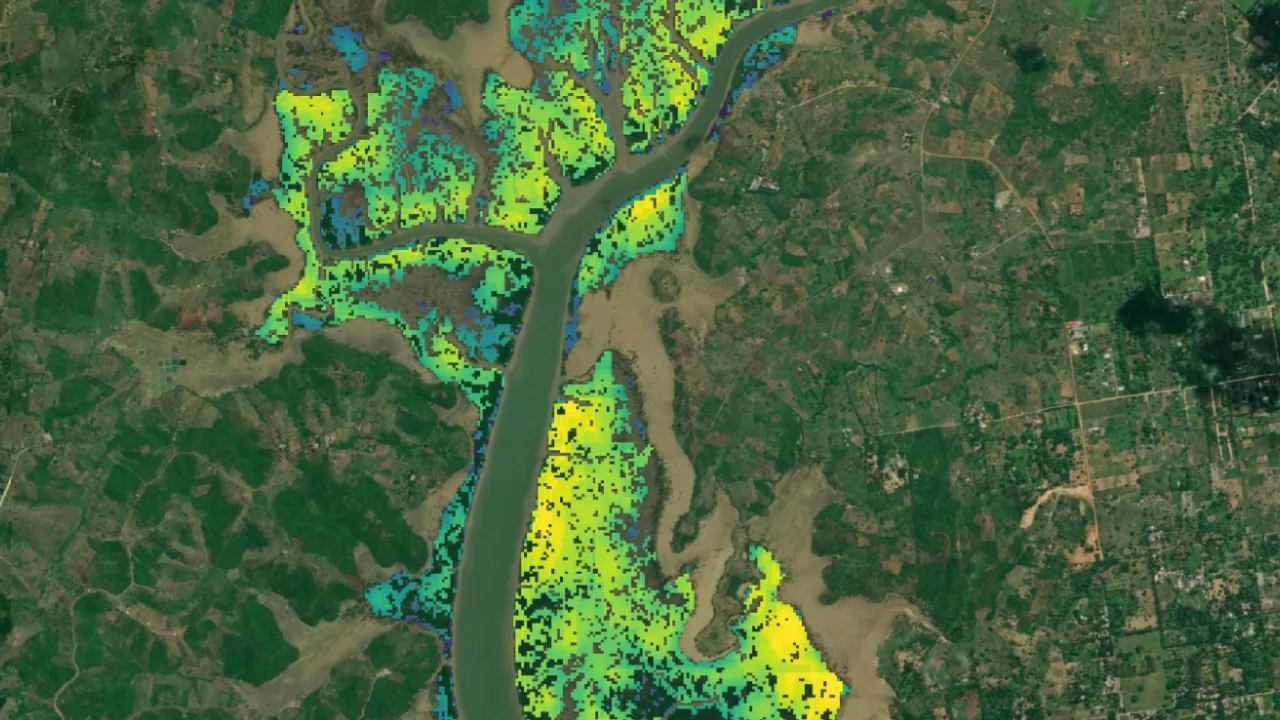

A high-quality project is complex; here at Treeconomy, we strive for just that. Our best-in-class monitoring technology can equip developers and investors with confidence and trust and delivers de-risked, data-backed credits for buyers on our marketplace.

–

Ready to purchase carbon credits with us?

Explore our pipeline of projects by visiting Treeconomy’s marketplace here or contact us at hello@treeconomy.co.